- ホーム

- Bookkeeping

- Accounting For Direct Labor Costs Definition, Example, And Accounting Treatment

Accounting For Direct Labor Costs Definition, Example, And Accounting Treatment

2024年08月29日

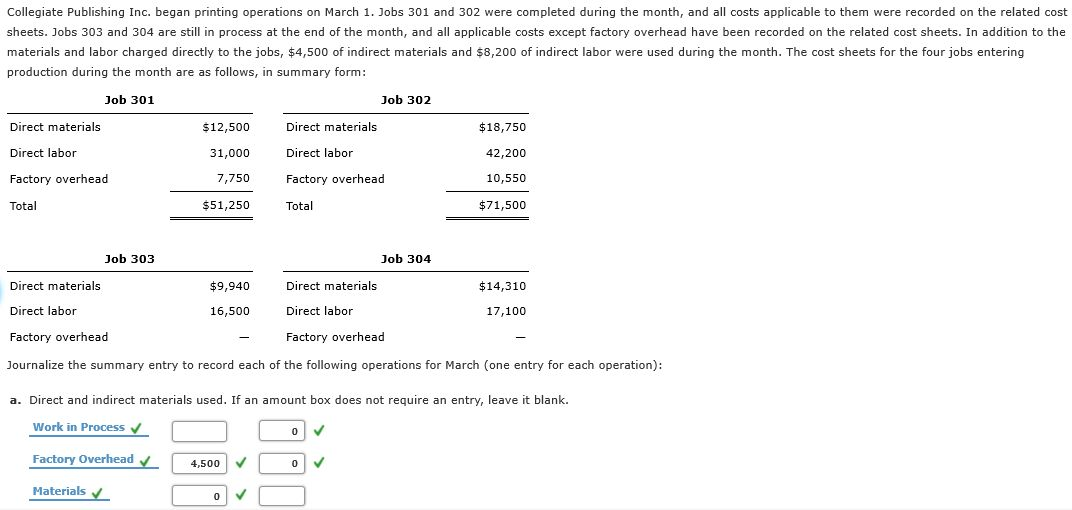

Wheneverwe use an estimate instead of actual numbers, it should be expectedthat an adjustment is needed. We will discuss the differencebetween actual and applied overhead and how we handle thedifferences in the next sections. Whatever the setting is, tracking and managing direct labor costs and rates can help management optimize the production process, keep costs low, and improve efficiency.

Accounting

If the actual overheadexceeds the applied overhead, they may wish to learn why the actualoverhead is so high. Also, they may ask the accountants to increasethe overhead applied to jobs to give them a better idea of the costof jobs. If the actual is less than the applied overhead, they mayask the accountants to reduce the overhead applied to jobs.

Direct Labor Costs Vs Indirect Labor Costs

Direct labor costs are included in the company’s inventory accounts until the goods are sold. From the work-in-process inventory account, costs move to the finished goods account as the manufacturing process is completed. This movement is reflected in the accounting records with a debit to finished goods and a credit to work-in-process inventory. When the goods are sold, they are removed from finished goods inventory and shipped to customers. First, a debit is made to the cost of goods sold account and a credit is made to the finished goods account. Last, a debit is made to the accounts receivable account and a credit is made to the sales revenue account.

Using a Predetermined Overhead Rate

This is because Direct Labor costs are expenses innature, and therefore, they are supposed to be treated as such. When theyincrease, they are debited, and the relevant credit entry depends on whetherthe payment has been made to these employees or not. An example of Direct Labor would be the wages andsalaries paid to workers who are working on the production self employed invoice template line to create andassemble a given product. Direct Labor Costs can be defined as payroll costs that are incurred to manufacture a certain product. These are the costs that can directly be traceable and attributable to a certain product. A liability is a present obligation for an organization to provide cash or some other service in the future.

During the finishing stages, $120 in grommets and $60 in wood are requisitioned and put into work in process inventory. The costs are tracked from the materials requisition form to the work in process inventory and noted specifically as part of Job MAC001 on the preceding job order cost sheet. An organization-wide predetermined manufacturing overhead rate is computed by dividing the total estimated manufacturing overhead amount by the total estimated allocation base or cost driver. An allocation base or cost driver is a production activity that drives costs such as direct labor hours, machine hours, direct labor dollars, or direct material dollars.

2 Describe and Identify the Three Major Components of Product Costs under Job Order Costing

The inventory accounts commonly used in a job-order costing system include the Raw Materials account, Manufacturing Overhead account, Work in Process account, and Finished Goods account. Product costs, or manufacturing costs, flow through these accounts until the product is complete. The total cost to manufacture the finished product is held in the Finish Goods inventory account until the product is sold. In job order costing, the direct labor will be transferred to the working in progress account while the indirect labor will be transferred to the manufacturing overhead account. Direct labor costs refer to the wages and salaries paid to employees who are directly involved in the production of a specific product or the provision of a specific service.

- Before multiple predetermined manufacturing overhead rates can be computed, manufacturing overhead costs must be assigned to departments or processes.

- On the 10th of July, Jackie purchased supplies, like paint and graphics and lacquer, that would be used during production but can’t be traced directly to any particular job.

- Along with these direct materials and labor, the project will incur manufacturing overhead costs, such as indirect materials, indirect labor, and other miscellaneous overhead costs.

- At the same time, the revenue collected from the sale is recorded in the Sales revenue account.

The expense recognition principle also applies to manufacturing overhead costs. The manufacturing overhead is an expense of production, even though the company is unable to trace the costs directly to each specific job. For example, the electricity needed to run production equipment typically is not easily traced to a particular product or job, yet it is still a cost of production. As a cost of production, the electricity—one type of manufacturing overhead—becomes a cost of the product and part of inventory costs until the product or job is sold. Fortunately, the accounting system keeps track of the manufacturing overhead, which is then applied to each individual job in the overhead allocation process.

For example, an organization that produces a labor intensive product might select direct labor hours as the allocation base. Whereas, an organization that relies on machines instead of laborers might use machine hours as the allocation base. While many types of production processes could be demonstrated, let’s consider an example in which a contractor is building a home for a client. The accounting system will track direct materials, such as lumber, and direct labor, such as the wages paid to the carpenters constructing the home.

The process of creating this estimate requires the calculation of a predetermined rate. For example, a furniture factory classifies the cost of glue, stain, and nails as indirect materials. Nails are often used in furniture production; however, one chair may need 15 nails, whereas another may need 18 nails. At a cost of less than one cent per nail, it is not worth keeping track of each nail per product. It is much more practical to track how many pounds of nails were used for the period and allocate this cost (along with other costs) to the overhead costs of the finished products. Nails are often used in furniture production; however, one chair may need \(15\) nails, whereas another may need 18 nails.

Work in Process (WIP) is the inventory account where product costs–direct material, direct labor, and manufacturing overhead–are accumulated while the jobs are in the manufacturing process. Moreover, it’s just as crucial to keep track of indirect labor expenditures as it is of direct labor costs. Indirect labor, on the other hand, is recorded as overhead rather than the cost of products sold. Notice, Job 105 has been moved from FinishedGoods Inventory since it was sold and is now reported as an expensecalled Cost of Goods Sold. Also, did you notice that actualoverhead came to $9,800 ($1,000 indirect materials + $2,000indirect labor + $6,800 other overhead from transaction g) but weapplied $9,850 in overhead to the jobs in transaction d?

In this journal entry, the labor cost account includes both direct labor and indirect labor. And the payroll taxes payable account is a current liability account that the company owes to the applicable governing authorities. The company can make the journal entry for direct labor and indirect labor that incurs during the period by debiting the labor cost account and crediting the wages payable account and the payroll taxes payable account.